20 New Advice For Deciding On AI Stock Investing Analysis Sites

20 New Advice For Deciding On AI Stock Investing Analysis Sites

Blog Article

Top 10 Tips On Assessing The Data Quality And Sources Of Ai Platform For Predicting And Analyzing Trades

It is vital to examine the quality of data and sources utilized by AI-driven trading platforms and platforms for stock predictions to ensure accurate and reliable data. Poor data quality can lead to flawed predictions, financial losses, and distrust of the platform. Here are 10 methods to assess the quality of data and source:

1. Verify the Data Sources

Find out the source of the data. Make sure the platform is using trusted and reliable data providers, such as Bloomberg, Reuters or Morningstar.

Transparency - The platform must be transparent about its data sources and update them regularly.

Avoid single-source dependency: Reliable platforms often collect data from multiple sources to reduce bias and errors.

2. Check Data Freshness

Real-time data vs. delayed data: Find out if the platform provides actual-time data, or delayed data. Real-time information is essential to ensure that trading is active. Data that is delayed can be sufficient for long term analysis.

Update frequency: Check when the information is changed.

Historical data consistency: Make sure that historical data is free of gaps and anomalies.

3. Evaluate Data Completeness

Find missing data. Look for gaps in the historical data, missing tickers or financial statements that aren't complete.

Coverage: Check that the trading platform is able to support an extensive range of stocks and indices pertinent to your plan.

Corporate actions: Find out if your platform takes into account stock splits and dividends along with mergers and other corporate events.

4. Accuracy of test data

Cross-verify data : Check the platform data with that of other trustworthy sources to ensure that the data is consistent.

Look for errors: Search for any anomalies, price errors, and mismatched financial metrics.

Backtesting: You may use old data to test strategies for trading. Examine if they meet your expectations.

5. Examine the Data Granularity

Detail You should find the most precise information, including intraday volumes and prices, bid/ask spreads, and order books.

Financial metrics: See if the platform has complete financial statements (income statement, balance sheet, cash flow) and the most important ratios (P/E P/B, ROE, etc. ).

6. Verify that the Data Cleaning is in place and Preprocessing

Data normalization. Make sure that the platform is normalizing data in order to maintain consistency (e.g. by changing dividends, splits).

Outlier handling: Find out the way in which the platform handles outliers or anomalies in the data.

Incorrect data: Determine whether the platform is using effective techniques to fill in missing data points.

7. Examine data consistency

Make sure that all data is aligned to the same timezone. This will avoid discrepancies.

Format consistency: Ensure that data is formatted in the same format.

Check for consistency across markets: Compare data from different exchanges and/or markets.

8. Relevance of Data

Relevance for trading strategy - Be sure the data matches your trading style (e.g. quantitative modeling and quantitative analysis, technical analysis).

Selecting features : Ensure that the platform includes features that are relevant and can enhance your forecasts.

Review Data Security Integrity

Data encryption: Make sure the platform is using encryption to protect data storage and transmission.

Tamper-proofing : Make sure that the data hasn't been altered by the platform.

Compliance: Find out whether the platform is in compliance with the regulations on data protection.

10. Transparency in the AI Model of the Platform is evaluated

Explainability. You must comprehend how the AI uses data to come up with predictions.

Bias detection: Determine whether the platform monitors and mitigates biases in the model or data.

Performance metrics. Evaluate performance metrics such as precision, accuracy, as well as recall to assess the reliability of the system.

Bonus Tips

Reviews and feedback from users Review and feedback from users: Use user feedback to determine the reliability of a website and its data quality.

Trial period: Try the platform free of charge to test the functionality and the features available before committing.

Support for customers: Make sure the platform offers robust customer support for issues with data.

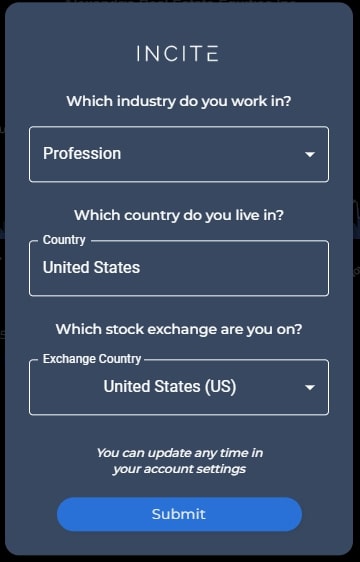

These tips will allow you to analyze the data quality, source, and accuracy of AI-based stock prediction platforms. Have a look at the best best ai stock trading bot free tips for blog tips including chatgpt copyright, chatgpt copyright, chart ai trading assistant, investment ai, ai investing app, ai stock market, incite, best ai stock trading bot free, ai stock trading app, ai investing app and more.

Top 10 Tips On Assessing The Reputation And Reviews Of Ai Stock-Predicting And Analyzing Trading Platforms

It is important to assess the reputation and reviews for AI-driven trading and stock prediction platforms to be sure of their trustworthiness, reliability and efficiency. Here are 10 guidelines on how to evaluate the reviews and reputation of these platforms:

1. Check Independent Review Platforms

Read reviews of reliable platforms such as G2, copyright, and Capterra.

The reason: Independent platforms provide unbiased feedback from real users.

2. Examine User Testimonials and Study Case Studies

User testimonials or case studies by visiting the platform's own website, and also on third-party sites.

What are the benefits? They provide insight into the real-world performance of a system and satisfaction of users.

3. Evaluate Expert Opinions and Industry Recognition

TIP: Check whether any experts in the field or analysts with a reputation have reviewed the platform, or recommended it.

Expert endorsements add credibility to the claims made by the platform.

4. Examine Social Media Sentiment

TIP Be on the lookout for social media platforms such as Twitter, LinkedIn and Reddit to find out what people have to say about them.

Social media lets you observe the opinions and views of users and trends.

5. Verify Regulatory Compliant

Tip: Verify that the platform is in compliance with the laws on data privacy as well as financial regulations.

Why? Compliance is essential in order to make sure that the platform operates legally and ethically.

6. Seek out transparency in performance indicators

TIP: Find out if the platform has transparent performance metrics including accuracy rates, ROI and backtesting results.

Transparency is important as it helps build trust and users can evaluate the effectiveness of the platform.

7. Check out the Quality of Customer Support

Read the reviews to get information about customer service and its effectiveness.

Why: Reliable support is crucial to resolve issues and ensuring a positive user experience.

8. Be sure to look for Red Flags in Reviews

TIP: Pay attention to frequent complaints like ineffective service, hidden fees or lack of updates.

The reason: A pattern of consistently negative feedback can indicate problems on the platform.

9. Examine community and user engagement

TIP: Find out if the platform has an active community of users (e.g. forums, forums, Discord groups) and communicates with users frequently.

Why is that a active community will indicate user satisfaction and continued support.

10. Take a look at the history of the company.

Find out the history of the company including leadership, previous performance and prior achievements in the area of financial technology.

Why? A proven track record can increase confidence in the platform’s reliability and knowledge.

Compare Multiple Platforms

Compare the reputation and reviews of multiple platforms in order to determine which one best suits your needs.

With these suggestions, you can thoroughly assess the reputation and reviews of AI trading and stock prediction platforms. You should make sure that you choose a trustworthy and effective solution. See the top our site about investing with ai for site recommendations including ai trading tool, ai stock trader, how to use ai for stock trading, ai options, ai stock predictions, best stock prediction website, ai for trading stocks, ai software stocks, ai in stock market, ai in stock market and more.